HOW AN APPRAISER DETERMINES VALUE ON A PROPERTY

Understanding the Key Principles of Value is crucial for accurate pricing, market awareness, and maximizing property value. It helps buyers, sellers, and agents make informed decisions, reduce risks, and strengthen negotiation power.

These principles guide smart investments, property improvements, and financial planning, ensuring successful and profitable real estate transactions. By applying these principles, real estate professionals can set realistic prices, help clients make smart investment decisions, and navigate market fluctuations effectively. Education buyers and sellers about these factors strengthens trust and leads to more successful transactions.

Principal of Anticipation

The principle of anticipation states that a property's value is influenced by expected future benefits, appeal, or events. If buyers anticipate strong future benefits, the property's value increases; if expectations are low, the value decreases. Appraisers consider known future improvements—such as new freeways, schools, hospitals, and commercial developments—that could boost demand and enhance property value.

Principal of Balance

The principle of balance states that land value is maximized when there is an optimal balance of internal and external property elements. Market equilibrium occurs when the four factors of production—capital, entrepreneurship, labor, and land—are in balance. Appraisers assess various influences, including market cycles, political actions, and economic, physical, environmental, and sociological forces, to determine real estate values.

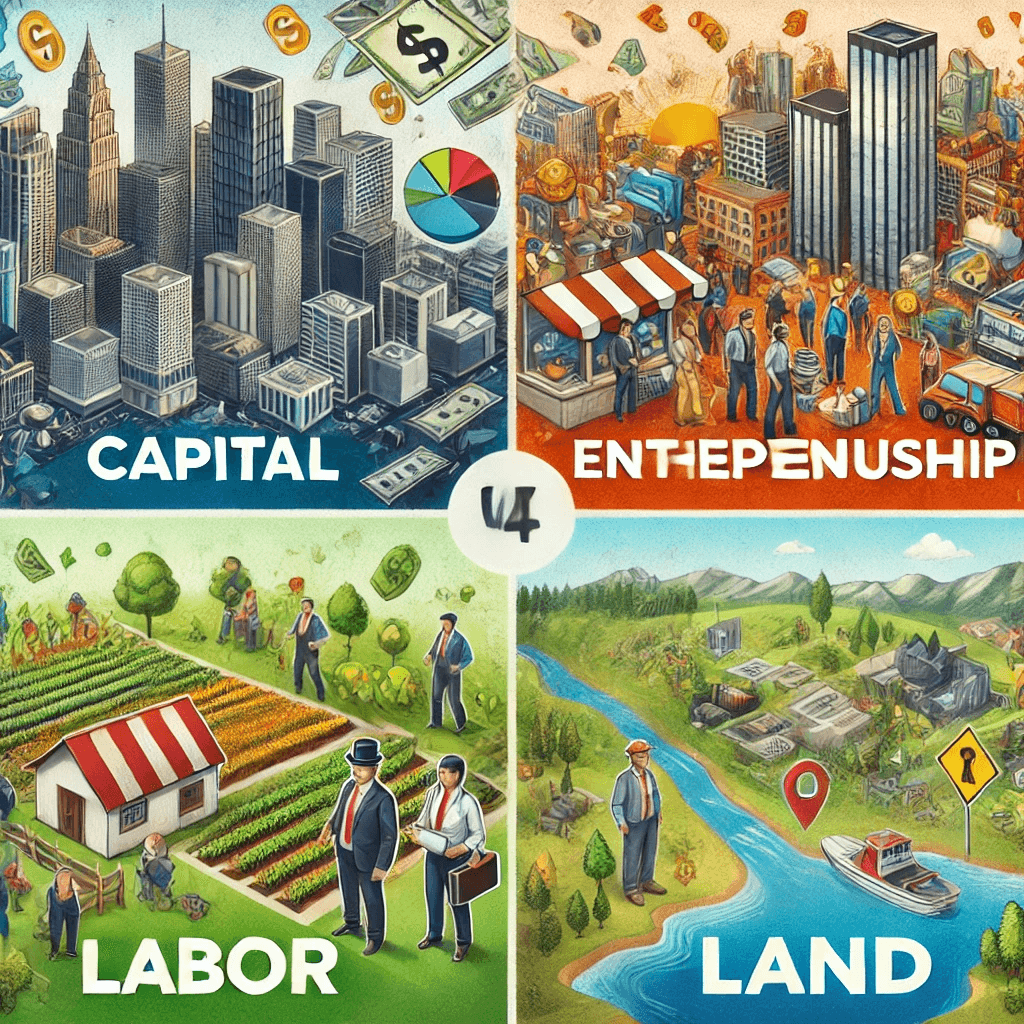

Principal of Change

The value of a parcel of land is constantly influenced by various forces, making an appraisal relevant only for a limited time. The principle of change acknowledges that these forces can be either specific to the property or external. The four broad categories that affect value are:

- Capital – Availability of financial resources and investment in the area.

- Entrepreneurship – Business activity and economic development driving demand.

- Labor – Workforce availability and employment trends impacting property desirability.

- Land – Natural resources, location, and land-use regulations influencing value.

Principal of Competition

The presence or absence of competition directly impacts property value. Buyers compete for homes that meet their needs, while sellers compete for qualified buyers within the market. According to the principle of competition, properties on the market vie for buyers' attention.

Buyers typically compare multiple homes before making a purchase, meaning properties must stand out to justify their price—especially if they are at the top of a buyer’s budget. A home with desirable features can command a higher value by differentiating itself from competing properties.

Principal of Conformity

The principle of conformity in real estate suggests that property values are maximized when there is a reasonable degree of similarity within a neighborhood. Homes tend to align in value with their surroundings, following market trends. This concept ties into the principles of progression and regression: a lower-value home in a desirable area may benefit from its surroundings, while an over-improved home may not achieve its full value potential if the neighborhood’s market does not support it. Conformity ensures that properties maintain or enhance value based on their fit within the market.

Principle of Progression

The Principle of Progression states that a lower-valued property will generally see an increase in value when it is surrounded by higher-valued properties. This is because the superior quality and desirability of the neighboring properties positively influence the perception and marketability of the lesser-quality property.

Principle of Regression

The principle of regression states that an over-improved property will be devalued if it is surrounded by lower-quality homes. Market forces naturally adjust prices based on surrounding properties, meaning a high-end home in an average neighborhood will have its value pulled down to align with the area’s overall market standard.

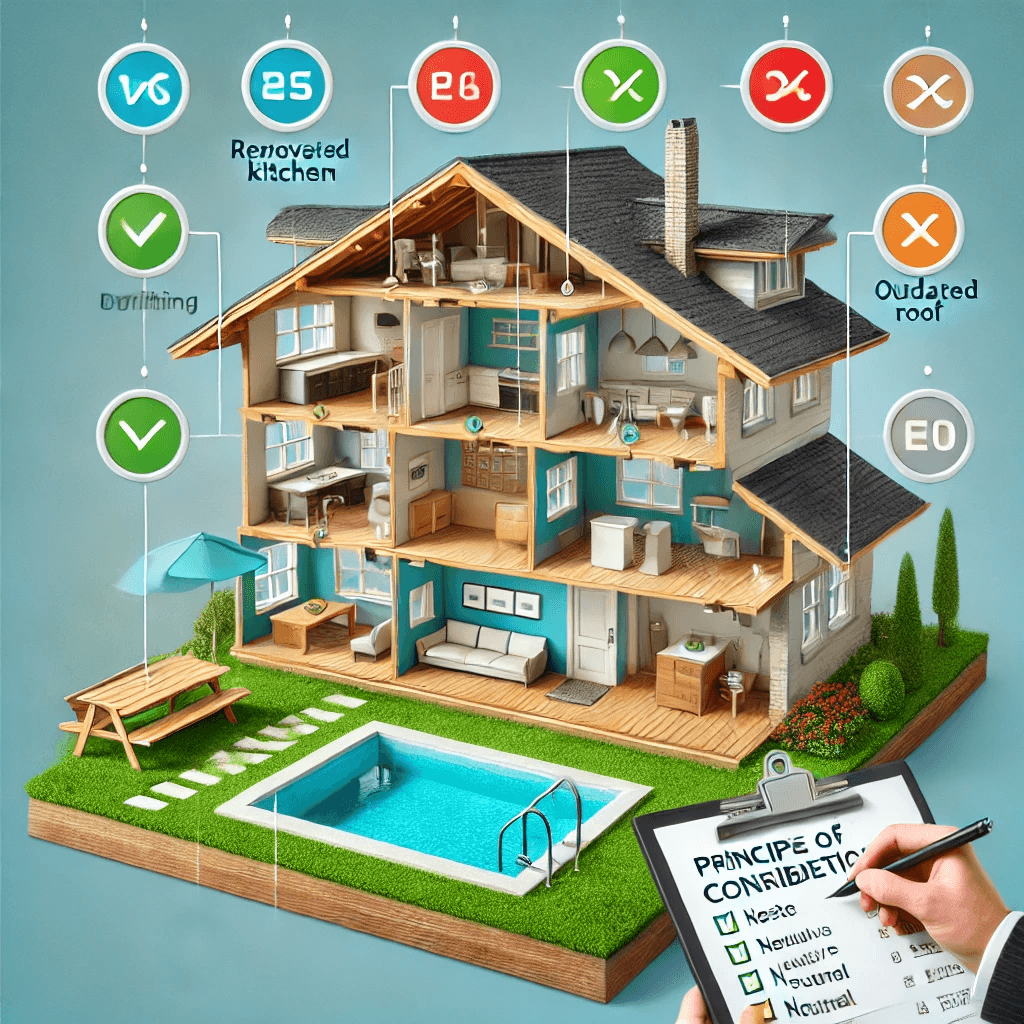

Principle of Contribution

The principle of contribution states that a property's value is the sum of the contributory value of each of its individual components. The key takeaway for appraisers is that cost does not necessarily equal value. It is the appraiser's role to assess how much a typical buyer would pay for specific improvements and property features. Contributory value can be positive, negative, or neutral depending on how each element affects the overall property value.

Principle of Externalities

Externalities refer to factors outside a property that can impact its value, either positively or negatively. These forces can be broader, like regional economic conditions, or more localized, such as conditions directly surrounding the property. Externalities may affect the value of the specific property in question, comparable properties, or even the entire market area, depending on the scope and nature of the influence.

Principle of Substitution

At the core of appraisal methodology is the principle of substitution, which states that the value of a property is influenced by the cost of acquiring a comparable substitute. In the sales comparison approach, the subject property is compared to similar properties (comparables). A rational buyer is unlikely to pay more for a property if a similar one is available at a lower price or offers better value.